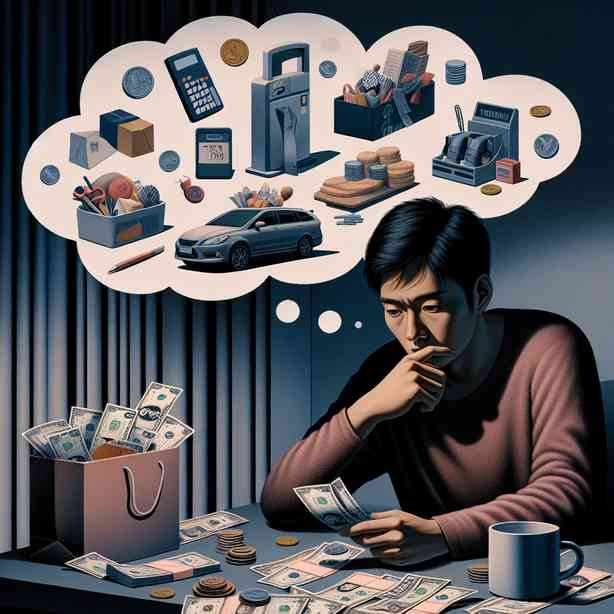

When You Try to Remember What You Spent

Managing finances can sometimes feel like a daunting task. In today’s fast-paced world, it’s easy to lose track of our expenditures, especially with the convenience of digital payments and online shopping. Many people find themselves in a situation where they sit down to review their spending, only to feel overwhelmed and confused about where their money has gone. Understanding how to track and manage your finances effectively can lead not only to better budgeting but also to a more secure financial future.

Remembering what you spent involves more than just recalling numbers; it encompasses understanding your spending habits, preferences, and even emotional triggers that drive your financial decisions. A key aspect of this is keeping accurate and detailed records. With today’s technology, there are numerous applications and software designed to help you monitor your spending effortlessly. Using budgeting tools that link to your bank accounts can provide a clear overview of your expenses in real time. This not only allows you to see where your money is going but also enables you to spot trends in your spending behavior.

In addition to tracking your expenses, it’s essential to categorize your spending. By dividing your expenses into different categories—such as groceries, entertainment, bills, and transportation—you can identify areas where you may be overspending. This categorization can bring to light habits you may not even be aware of. For instance, you might discover that you tend to indulge in frequent takeout meals, which can add up significantly over time. Once you recognize these patterns, you can make more informed decisions about where to cut back and how to allocate your finances more effectively.

Moreover, reflecting on your spending can provide deep insights into your values and priorities. Ask yourself questions about why you purchased certain items. Were they necessary, or were they driven by impulse? Were they purchases that brought you joy or simply filled a void? Understanding the motivations behind your spending can help you make more conscious financial decisions in the future.

Budgeting is not just a monthly chore; it’s a powerful practice that can free you from financial stress. Setting a realistic budget requires some initial effort but pays off immensely in the long run. Start by listing your income and all fixed expenses, such as rent or mortgage, utilities, and loan payments. After determining these essentials, you can allocate funds for variable expenses, like groceries and entertainment. Remember to leave some room for savings and unexpected expenses as well, as life often brings surprises that can affect your financial stability.

If you find it difficult to stick to a budget, consider implementing the envelope system. This method involves dividing cash into different envelopes labeled for each spending category. When the cash in an envelope is gone, it’s a cue that you need to cease spending in that category. This simple yet effective strategy can help curb overspending and encourage mindful spending habits.

Another critical aspect of financial management is reviewing your statements regularly. Take the time each month to go through your bank and credit card statements. This practice not only helps you remember what you spent but also brings to your attention any unfamiliar transactions, allowing you to spot potential errors or even fraud. Regular account reviews will keep you informed about your financial standing and help you adjust your budget as necessary.

Integrating a habit of financial reflection can also be highly beneficial. At the end of each month, sit down and review your spending. Ask yourself whether you met your budget goals and if your spending aligns with your values. Were there any surprises? What changes can you implement for the following month? This practice reinforces accountability and helps solidify your financial habits.

It’s also essential to distinguish between needs and wants. As human beings, we often confuse the two, which can lead to unnecessary expenditures. Needs are those things that are essential for your well-being, such as food, shelter, clothing, and healthcare, while wants are the things that enhance your quality of life—new gadgets, meals at fancy restaurants, or the latest fashion trends. By clearly defining these categories for yourself, you can prioritize your spending effectively and curb unnecessary purchases.

Furthermore, embracing a frugal mindset can have profound effects. Frugality does not equate to deprivation; rather, it’s about making conscious choices, finding value, and appreciating experiences over possessions. When you approach spending with a sense of purpose, you may find that you can enjoy life’s offerings without overspending.

Finally, building an emergency fund is a crucial component of financial health. Life is unpredictable, and having a cushion can provide peace of mind that allows you to focus on everyday expenses without the looming fear of financial crises. Strive to save at least three to six months’ worth of living expenses in a separate account. This fund can serve as a safety net that keeps you grounded during tough times and helps prevent you from relying on credit cards or loans.

Remember, managing your finances is a journey, not a destination. It takes time and patience to develop healthy financial habits, and it’s perfectly okay to seek help if needed. Financial literacy is an ongoing process, and there are countless resources available, from budgeting workshops to financial advisors, that can support you on your path to financial wellness.

In conclusion, when you try to remember what you spent, consider it an opportunity for growth and learning. By tracking your expenses, categorizing your spending, and reflecting on your financial habits, you can take control of your financial destiny. Embrace budgeting as a tool for empowerment, prioritize needs over wants, and work towards building a secure future. Each small step you take today can lead to significant benefits down the road, allowing you to live a life of financial freedom and fulfillment.